What is comprehensive auto insurance? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with originality from the outset.

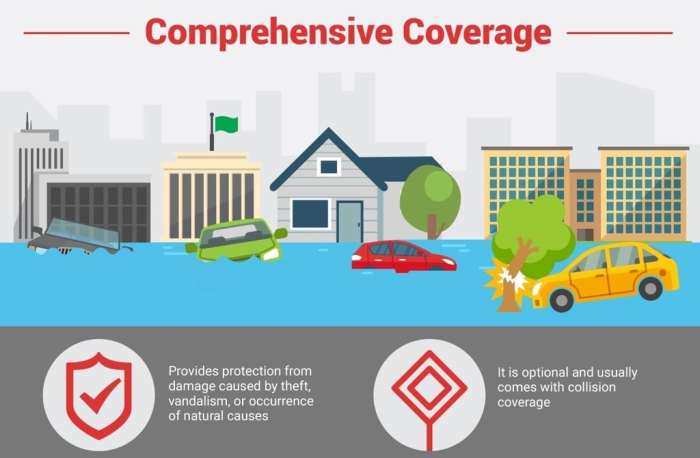

Comprehensive auto insurance provides a wide range of coverage for various situations, ensuring that you are protected in unforeseen circumstances. From damage caused by natural disasters to theft, comprehensive auto insurance goes beyond basic coverage to safeguard your vehicle.

What is Comprehensive Auto Insurance?

Comprehensive auto insurance is a type of coverage that helps protect your vehicle against damages not caused by a collision. It typically covers incidents such as theft, vandalism, fire, natural disasters, and falling objects.

Coverage Provided by Comprehensive Auto Insurance

- Damage from natural disasters like hurricanes, tornadoes, or floods.

- Loss or damage due to fire or explosions.

- Theft of the vehicle or its parts.

- Vandalism, such as keying or spray painting your car.

- Animal-related damages, like hitting a deer or other wildlife.

Examples of Situations Where Comprehensive Auto Insurance is Beneficial

- If your car is stolen and not recovered, comprehensive insurance can help cover the cost of a replacement.

- In the event of a tree falling on your car during a storm, comprehensive coverage can assist with the repairs.

- If your vehicle is damaged by a flood or hailstorm, comprehensive insurance can help cover the cost of repairs.

- When your car is vandalized with graffiti or broken windows, comprehensive coverage can help with the repair expenses.

Key Features of Comprehensive Auto Insurance

Comprehensive auto insurance is a type of coverage that protects your vehicle from damages that are not caused by a collision. It provides financial protection in case your car is stolen, vandalized, damaged by natural disasters, or encounters other non-collision related incidents. Below are the key features of comprehensive auto insurance:

Coverage for Non-Collision Damages

Comprehensive auto insurance covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, fire, floods, or falling objects. This coverage ensures that you are protected in various unpredictable situations.

Glass Coverage

Comprehensive insurance often includes coverage for glass damage, such as windshield cracks or shattered windows. This feature can be beneficial as repairing or replacing damaged glass can be costly.

Personal Property Coverage

Some comprehensive auto insurance policies also provide coverage for personal belongings that are stolen from your vehicle. This feature adds an extra layer of protection for your valuable items.

Compare to Collision and Liability Insurance, What is comprehensive auto insurance?

Comprehensive auto insurance differs from collision insurance, which covers damages caused by a collision with another vehicle or object. Liability insurance, on the other hand, covers damages and injuries to others in an at-fault accident. Comprehensive insurance is unique in that it covers a broader range of non-collision incidents.

Importance of Each Feature

Each feature of comprehensive auto insurance plays a crucial role in providing comprehensive coverage for your vehicle. From protecting against theft and vandalism to covering glass damage and personal belongings, these features ensure that you are financially protected in various scenarios.

Understanding Comprehensive Auto Insurance Coverage: What Is Comprehensive Auto Insurance?

When it comes to comprehensive auto insurance coverage, it is essential to understand the types of damage or incidents covered, as well as what is typically excluded from the coverage. Let’s delve deeper into the specifics of comprehensive auto insurance to gain a clearer understanding.

Types of Damage or Incidents Covered

Comprehensive auto insurance provides coverage for a wide range of damages and incidents that are not caused by a collision with another vehicle. This includes:

- Damage from natural disasters such as hurricanes, tornadoes, or floods.

- Theft or vandalism of your vehicle.

- Damage from falling objects such as trees or branches.

- Fire damage.

- Damage caused by hitting an animal, such as a deer.

- Broken or shattered windows.

What is Typically Not Covered

While comprehensive auto insurance offers robust coverage, there are certain situations that are typically excluded from the policy. These may include:

- Damage caused by a collision with another vehicle or object.

- Injuries to the driver or passengers in your vehicle.

- Mechanical failures or wear and tear on the vehicle.

- Custom parts or equipment not permanently installed in the vehicle.

- Damage from acts of war or terrorism.

Real-life Scenarios Illustrating Coverage

To better understand the extent of coverage under comprehensive auto insurance, consider the following real-life scenarios:

Scenario 1: A severe thunderstorm causes a tree to fall on your parked car, resulting in significant damage to the roof and windows. Comprehensive auto insurance would typically cover the cost of repairs in this situation.

Scenario 2: Your vehicle is broken into, and valuable items are stolen from inside. Comprehensive insurance would help cover the cost of replacing the stolen items and repairing any damage caused during the break-in.

Scenario 3: While driving on a rural road, a deer suddenly runs onto the highway and collides with your car, causing damage to the front bumper and headlights. Comprehensive auto insurance would generally cover the repairs needed after hitting an animal.

Factors Affecting Comprehensive Auto Insurance Rates

When it comes to comprehensive auto insurance rates, several factors come into play that can influence how much you will pay for coverage. Understanding these factors can help you make informed decisions when selecting a policy.

Deductible Amounts Impact on Rates

The deductible amount you choose for your comprehensive coverage can have a direct impact on your insurance rates. A higher deductible typically results in lower premiums, as you are agreeing to cover more of the costs out of pocket in the event of a claim. On the other hand, a lower deductible will lead to higher premiums since the insurance company will be responsible for a larger portion of the claim.

Vehicle’s Make, Model, and Age

The make, model, and age of your vehicle also play a significant role in determining your comprehensive auto insurance premiums. Newer, more expensive vehicles will generally cost more to insure, as they would be more costly to repair or replace in the event of damage or theft. Additionally, certain makes and models may be more prone to theft or vandalism, leading to higher insurance rates. Older vehicles, on the other hand, may have lower premiums due to their lower value and potentially lower repair costs.

In conclusion, comprehensive auto insurance offers a comprehensive safety net for your vehicle, covering a wide array of potential risks. By understanding the key features and benefits of comprehensive coverage, you can make informed decisions to protect your investment and drive with peace of mind.

When it comes to car insurance, understanding the minimum car insurance requirements is crucial. These requirements vary by state, so it’s important to know what is mandatory in your area.

Looking for the best collision car insurance rates can save you money in the long run. Compare quotes from different providers to find the most competitive rates for your coverage.

Opting for collision insurance with low deductible can provide you with peace of mind in case of an accident. A lower deductible means you’ll pay less out of pocket if you need to file a claim.