Comprehensive insurance for drivers with a history of accidents is a crucial aspect that can provide financial security and peace of mind in the face of uncertainties. This guide delves into the intricacies of comprehensive insurance, shedding light on its importance and benefits for those with a less-than-perfect driving record.

Exploring the nuances of coverage options, cost implications, and common misconceptions, this comprehensive overview aims to equip readers with the knowledge needed to navigate the complexities of insurance in the aftermath of accidents.

What is comprehensive insurance for drivers with a history of accidents?

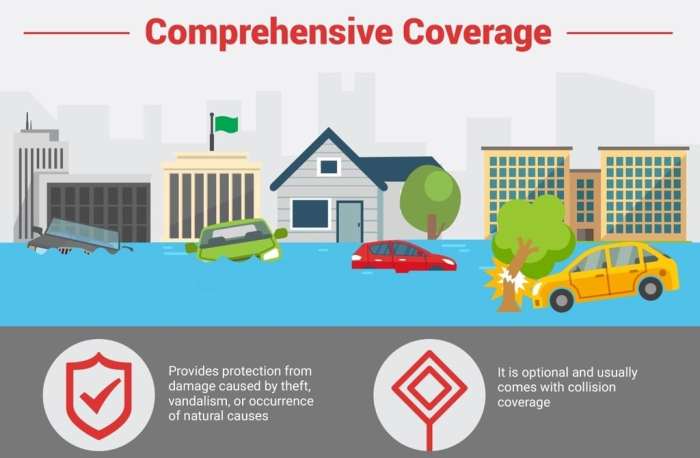

Comprehensive insurance for drivers with a history of accidents is a type of auto insurance coverage that provides protection against damages to your vehicle that are not caused by a collision. This type of insurance is particularly beneficial for drivers who have been involved in accidents in the past and want to ensure they are adequately covered for a variety of risks.

Coverage provided by comprehensive insurance

Comprehensive insurance typically covers damages to your vehicle caused by events such as theft, vandalism, natural disasters, falling objects, and animal collisions. It also often includes coverage for broken glass, fire, and damage from riots or civil disturbances.

Difference from other types of insurance

Comprehensive insurance differs from liability insurance, which covers damages to other vehicles and property in an accident for which you are at fault, and collision insurance, which covers damages to your vehicle in the event of a collision with another vehicle or object.

Examples of situations where comprehensive insurance is beneficial

– If your vehicle is stolen or vandalized

– If your car is damaged by a falling tree or hail

– If your vehicle is damaged by a flood or fire

– If your car is damaged by hitting an animal on the road

Cost implications of comprehensive insurance

Comprehensive insurance tends to be more expensive than liability insurance due to the broader coverage it provides. However, the cost of comprehensive insurance may vary depending on factors such as the value of your vehicle, your driving history, and where you live. It is important to weigh the cost of comprehensive insurance against the potential risks and benefits to determine if it is the right choice for you.

Factors to consider when seeking comprehensive insurance with a history of accidents: Comprehensive Insurance For Drivers With A History Of Accidents

When looking for comprehensive insurance with a history of accidents, there are several key factors to keep in mind to ensure you get the best coverage at a reasonable rate. It’s essential to understand how these factors can influence your insurance premiums and coverage options.

Driving Record Impact on Premium Rates

Your driving record plays a significant role in determining the premium rates for comprehensive insurance. If you have a history of accidents, your premiums are likely to be higher compared to drivers with a clean record. Insurance companies view past accidents as an indicator of potential risk, which can result in increased rates.

Importance of Comparing Quotes, Comprehensive insurance for drivers with a history of accidents

It’s crucial to compare quotes from different insurance providers when seeking comprehensive coverage with a history of accidents. By obtaining multiple quotes, you can identify the most competitive rates and coverage options available in the market. This comparison allows you to make an informed decision and choose the best policy that meets your needs.

Impact of Insured Vehicle Value

The value of your insured vehicle can also impact your coverage options for comprehensive insurance. Higher valued vehicles may require more comprehensive coverage to protect against potential damages. It’s important to consider the value of your vehicle when selecting coverage options to ensure adequate protection in case of an accident.

Tips to Improve Insurability

Despite having a history of accidents, there are steps you can take to improve your insurability and potentially lower your insurance premiums. These may include completing a defensive driving course, maintaining a clean driving record moving forward, and exploring discounts offered by insurance providers for safe driving habits. Taking proactive measures to improve your insurability can help offset the impact of a history of accidents on your insurance costs.

Common misconceptions about comprehensive insurance for drivers with accident history.

When it comes to comprehensive insurance for drivers with a history of accidents, there are several common misconceptions that can lead to confusion or missed opportunities for coverage. Let’s debunk some of these myths and clarify the benefits of comprehensive insurance for these drivers.

Myth: Comprehensive insurance is not necessary if you already have basic coverage.

Some drivers may believe that having basic insurance coverage is sufficient, especially if they have a history of accidents. However, comprehensive insurance provides additional protection that can be valuable in various situations.

- Comprehensive coverage can help pay for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Without comprehensive insurance, drivers may be left to cover these expenses out of pocket, which can be financially burdensome, especially after a previous accident.

Myth: Comprehensive insurance is too expensive for drivers with accident history.

While it’s true that insurance premiums may be higher for drivers with a history of accidents, comprehensive insurance can still be a cost-effective option considering the potential benefits it offers.

- Comprehensive coverage can help drivers avoid significant out-of-pocket expenses in case of non-collision-related damages to their vehicles.

- By weighing the potential costs of repairs or replacements without comprehensive coverage, drivers may find that the added protection is a worthwhile investment.

Situations where comprehensive coverage would have been useful for drivers with past accidents.

There are many scenarios where having comprehensive insurance could have been beneficial for drivers with a history of accidents:

- Damage caused by vandalism, such as keying, graffiti, or broken windows.

- Theft of the vehicle or its components, like tires or stereo systems.

- Destruction of the vehicle due to natural disasters like hurricanes, floods, or wildfires.

Filing a claim with comprehensive insurance after an accident.

When filing a claim with comprehensive insurance after an accident, drivers should follow these steps:

- Report the incident to your insurance provider as soon as possible.

- Provide any necessary documentation, such as photos of the damage, police reports, and repair estimates.

- Work with your insurance company to assess the damage and determine coverage for repairs or replacements.

Strategies for maximizing the benefits of comprehensive insurance with a history of accidents.

When it comes to maximizing the benefits of comprehensive insurance for drivers with a history of accidents, there are several strategies that can be implemented. These strategies can help drivers get the most out of their coverage, potentially reduce insurance costs, and provide peace of mind in the event of future accidents.

Maintaining a Good Driving Record

One key strategy for maximizing the benefits of comprehensive insurance is to maintain a good driving record. By driving safely and avoiding accidents, drivers can potentially reduce their insurance costs over time. This can be achieved by following traffic laws, avoiding distractions while driving, and being mindful of road conditions.

Role of Deductibles in Comprehensive Insurance

Deductibles play a crucial role in comprehensive insurance policies. Choosing the right deductible amount is essential for maximizing benefits. A higher deductible usually means lower premiums, but drivers should ensure they can afford the deductible in the event of a claim. It’s important to strike a balance between the deductible amount and potential out-of-pocket expenses.

Tips for Choosing the Right Deductible Amount

– Consider your financial situation and how much you can comfortably afford to pay out of pocket.

– Evaluate the difference in premiums between different deductible amounts to find the right balance.

– Take into account the value of your vehicle and the likelihood of filing a claim.

– Consult with your insurance provider to understand how different deductible amounts can impact your coverage and premiums.

Peace of Mind with Comprehensive Insurance

Comprehensive insurance can provide peace of mind for drivers with a history of accidents. Knowing that you have coverage for a wide range of incidents, including theft, vandalism, and natural disasters, can offer reassurance and financial protection. By understanding your policy, maintaining a good driving record, and choosing the right deductible amount, you can maximize the benefits of comprehensive insurance and drive with confidence.

In conclusion, Comprehensive insurance for drivers with a history of accidents offers a vital safety net for individuals seeking protection on the road. By understanding the key factors, dispelling myths, and implementing strategies for maximizing benefits, drivers can ensure they are adequately covered in times of need. Stay informed, stay safe, and drive with confidence knowing you have comprehensive insurance to back you up.

Liability car insurance covers the cost of damage or injuries you cause to others in an accident. It typically includes property damage and bodily injury liability. However, it does not cover your own car’s damages. To protect your vehicle, you may consider collision insurance, especially if your car is old. Learn more about whether you need collision insurance for an old car.

Comparing rates is essential to find the best coverage that suits your budget. Check out the best collision car insurance rates available in the market.

When it comes to car insurance, understanding what liability coverage includes is crucial. What does liability car insurance cover? It typically pays for the other driver’s medical bills and vehicle damage if you’re at fault in an accident. However, it doesn’t cover your own expenses. It’s important to know the extent of your coverage to avoid any surprises in the future.

Many drivers wonder if they need collision insurance for their older cars. Do I need collision insurance if my car is old? While older cars may not have a high resale value, collision insurance can still be beneficial in covering repair costs after an accident. Consider the value of your car and your financial situation before making a decision.

Looking for the best rates on collision car insurance? Best collision car insurance rates can vary depending on factors like your driving record, location, and the type of coverage you choose. Compare quotes from multiple insurers to find the most competitive rates that suit your needs and budget.