Collision insurance with low deductible is a crucial component of financial protection in case of a car accident. Let’s delve into the details of this essential coverage and explore how it can benefit you in unexpected situations.

Exploring the nuances of collision insurance with a low deductible can provide valuable insights into making informed decisions about your car insurance coverage.

Understanding Collision Insurance

Collision insurance is a type of car insurance coverage that helps pay for repairs to your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. This is different from liability insurance, which covers damage to another person’s vehicle or property if you are at fault in an accident.

When it comes to car insurance, having liability coverage can provide peace of mind for drivers. Benefits of liability car insurance include financial protection in case of accidents where the driver is at fault, as well as legal defense if needed. For those looking for the best liability car insurance , it’s important to compare rates and coverage options from different providers.

High-risk drivers can also find suitable coverage with liability insurance for high-risk drivers tailored to their needs.

Scenarios where Collision Insurance with Low Deductible is Beneficial

Having collision insurance with a low deductible can be beneficial in situations where you want to minimize your out-of-pocket expenses in the event of a car accident. For example, if you frequently drive in areas with heavy traffic or have a history of minor collisions, a low deductible can help reduce the financial burden of repairing your vehicle.

When it comes to car insurance, having liability coverage is essential for protecting yourself financially in case of an accident. Understanding the benefits of liability car insurance can help you make informed decisions about your coverage. It provides compensation for property damage and medical expenses for others involved in an accident you are responsible for.

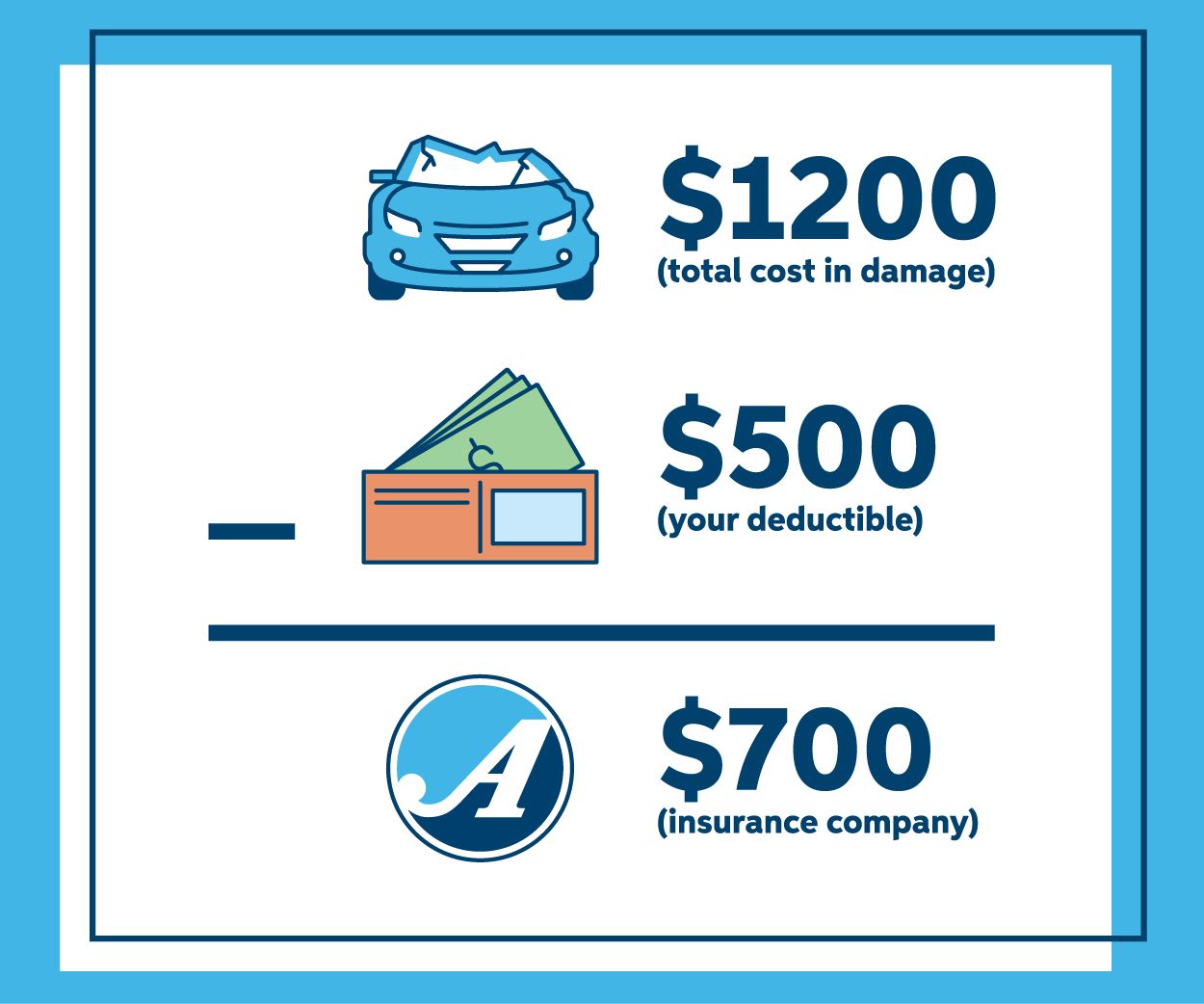

- Low deductible: A low deductible means you will have to pay less upfront before your insurance kicks in to cover the rest of the repair costs.

- Frequent accidents: If you are prone to getting into minor collisions or live in an area with high accident rates, having collision insurance with a low deductible can save you money in the long run.

- Peace of mind: Knowing that you have collision insurance with a low deductible can provide peace of mind and financial protection in case of an unexpected car accident.

Importance of Collision Insurance in Financial Protection

Collision insurance is essential in protecting yourself financially in case of a car accident. Without collision coverage, you would have to pay for repairs to your vehicle out of pocket, which can be expensive and financially burdensome. By having collision insurance with a low deductible, you can ensure that you are not caught off guard by the costs of repairing your vehicle after an accident.

Searching for the best liability car insurance can be overwhelming with so many options available. Look for a policy that offers adequate coverage limits and affordable premiums. It’s important to compare quotes from different insurers to find the most suitable option for your needs.

Benefits of Low Deductible Collision Insurance

.png/9025a687-d4ba-450f-fa19-12a92c3cb212?imagePreview=1?w=700)

When it comes to collision insurance, opting for a low deductible can offer various advantages that can give you peace of mind and financial protection in case of an accident.

Cost Implications of Low vs. High Deductible

- Low Deductible: Choosing a lower deductible means you’ll have to pay less out of pocket in the event of a collision. This can be especially beneficial if you’re on a tight budget or don’t have substantial savings to cover a higher deductible.

- High Deductible: On the other hand, a higher deductible typically results in lower monthly premiums. While this can save you money in the short term, it also means you’ll have to pay more upfront if you do get into an accident.

Tips for Choosing the Right Deductible

- Evaluate Your Finances: Consider your financial situation and how much you can comfortably afford to pay in case of a collision. If a higher deductible would put a strain on your budget, opting for a lower deductible may be the better choice.

- Assess Your Driving Habits: If you have a history of accidents or tend to drive in high-risk areas, a lower deductible could provide added protection and peace of mind.

- Compare Premiums: Request quotes from insurance providers for different deductible amounts to see how they impact your premiums. This can help you find a balance between cost and coverage that suits your needs.

Factors to Consider When Choosing Collision Insurance: Collision Insurance With Low Deductible

When selecting collision insurance with a low deductible, it is crucial to consider various factors that can influence the cost and coverage provided. Factors such as the type of vehicle, driving record, and location play a significant role in determining insurance premiums. Evaluating different insurance providers offering collision coverage can help you make an informed decision that meets your needs and budget.

Type of Vehicle

The type of vehicle you drive can greatly impact the cost of collision insurance. Generally, newer and more expensive vehicles will have higher insurance premiums due to the increased cost of repairs or replacement. Additionally, factors such as safety ratings, theft rates, and repair costs specific to your vehicle model can also influence the insurance premium.

Driving Record

Your driving record is another key factor that insurance companies consider when determining collision insurance rates. A clean driving record with no accidents or traffic violations can result in lower premiums, as it demonstrates that you are a low-risk driver. On the other hand, a history of accidents or traffic violations may lead to higher insurance costs.

Location

The location where you primarily drive and park your vehicle can impact collision insurance rates. Urban areas with higher rates of accidents, theft, or vandalism may result in higher premiums compared to rural areas. Additionally, factors such as local weather conditions, traffic congestion, and crime rates can also influence insurance costs.

Evaluating Insurance Providers

When comparing different insurance providers offering collision coverage, it is essential to consider factors beyond just the premium cost. Look into the reputation of the insurance company, their customer service reviews, claims process efficiency, and the range of coverage options available. Additionally, consider any discounts or benefits offered by the insurance provider that can help you save on premiums without compromising coverage.

Tips for Making a Collision Insurance Claim

When it comes to making a collision insurance claim, there are specific steps that policyholders need to follow to ensure a smooth process. This includes preparing necessary documentation and avoiding common mistakes that could delay or complicate the claims process.

Steps Involved in Making a Collision Insurance Claim

- 1. Contact Your Insurance Company: The first step is to notify your insurance company about the accident and file a claim. Provide them with all the relevant details, including the date, time, and location of the accident.

- 2. Document the Damage: Take photos of the damage to your vehicle and gather any other evidence, such as witness statements or police reports, to support your claim.

- 3. Get an Estimate: Obtain an estimate for the cost of repairs from a reputable auto body shop to submit to your insurance company.

- 4. Review Your Policy: Familiarize yourself with your collision insurance policy to understand the coverage limits and deductible amount.

- 5. Cooperate with the Claims Adjuster: Work closely with the claims adjuster assigned to your case, providing them with all requested information and documentation in a timely manner.

What Policyholders Need to Prepare When Filing a Claim

- 1. Insurance Information: Have your insurance policy details readily available, including your policy number and contact information for your insurance company.

- 2. Accident Details: Be prepared to provide a detailed account of the accident, including the circumstances leading up to the collision and any other relevant information.

- 3. Vehicle Information: Provide the make, model, and year of your vehicle, as well as the VIN number and current mileage.

- 4. Repair Estimates: Obtain and submit repair estimates from reputable auto body shops to support your claim.

Common Mistakes to Avoid During the Claims Process

- 1. Delaying Reporting the Accident: It’s crucial to report the accident to your insurance company promptly to avoid any potential issues with your claim.

- 2. Providing Incomplete Information: Make sure to provide all necessary information and documentation to support your claim fully.

- 3. Exceeding Policy Limits: Be mindful of your coverage limits and deductible to avoid unexpected out-of-pocket expenses.

- 4. Not Following Through: Stay engaged in the claims process and respond promptly to any requests or inquiries from your insurance company.

In conclusion, Collision insurance with low deductible offers peace of mind and financial security during uncertain times on the road. Make sure to consider this coverage when planning your car insurance policy to safeguard your finances effectively.

For high-risk drivers , liability insurance is especially important. It provides protection in case of accidents caused by your driving history or behavior. While premiums may be higher for high-risk drivers, having liability coverage is crucial for financial security on the road.